When it comes to the May housing market, one can quote E. M. Remark – there is nothing new on the real estate market front. Sales did not grow, but the supply, according to the estimates of some real estate analysts, was fixed even lower than in April. In other words, neither buyers nor real estate developers are in a hurry. But the prices, however, do not stand still: although a few dozen euros, but rose. Today, the average 1 sq. m. of an apartment sold in Vilnius. m. the price amounted to 3,299 euros. Read more in the review.

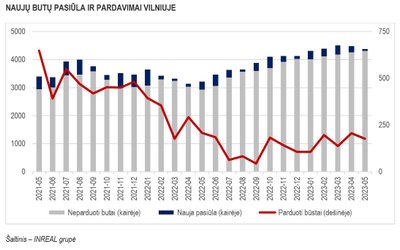

Tomas Sovijus Kvainickas, head of investment and analysis at Inreal Group, says that in May 2023, the activity of the primary housing market in Vilnius remained similar compared to April. He estimates that 249 home purchases have been agreed (excluding cancellations) – 12 per cent more than in April (223) and 8 per cent more than in May last year (230). On the other hand, the total number of sales, taking into account the cancelled agreements, decreased by 14% compared to April (from 207 to 177). This was mainly influenced by 72 homes returned to the market (there were 16 in April).

"The largest part of may's cancellations consisted of the return of one project corps to the supply. All dwellings in this building were marked as sold in October 2022. At that time, we assumed that the developer planned to rent or sell these apartments to an institutional investor for the same rental purpose, or simply provided for the start of sales of these housing units later. It looks like that's what happened – the homes have been brought back to the market," says T. S. Kvainick. Other cancellations are scattered singly or in several apartments in different projects of the capital.

Marijonas Chmieliauskas, sales director of the real estate company Realco, who also records a decrease in real estate sales, says that the reason for this is the deterioration of economic circumstances. According to him, the increase in the 6-month EURIBOR interest rate is having a major impact on sales, which is currently at 3.78 per cent, compared to 3.622 per cent last month. Accordingly, fewer new loans are issued – according to the data of the Bank of Lithuania, this year they were granted by 17 per cent less, compared to the same period in 2019. "If last year housing affordability decreased due to the growth of real estate prices, then now the purchasing power of the population is most reduced by rising interest rates and, as a result, loans becoming more expensive," says M. Chmieliauskas.

Housing depot declined In May, there was a fixed and smaller supply of new housing. According to T. S. Kvainick's calculations, 64 objects were recorded in the May offer. This is almost 4 times less than in April (231) and almost 5 times less than in May last year (294). "It is true that the observations did not include a new project in Užupis, the sales of which, although it was announced, but the detailed information of the website is not yet publicly available. Housing and pre-sales for this project are likely to open to the market in June. The amount of supply (apartments, lofts, cottages, including reserved housing) decreased from 4482 to 4369 units," the real estate analyst calculates.

The decline of the housing warehouse for the second month in a row is also recorded by M. Chmieliauskas, but, according to him, new projects in Vilnius may soon appear.

"Due to the difficulty of financing opportunities and the increase in the cost of loans, stagnation in the market does not lead to the emergence of new larger projects that could replenish the still sparse housing warehouse," he says.

Prices in Vilnius grew slightly according to hanner data, today the average size of an apartment sold in Vilnius is 1 sq. m. m. the price amounted to 3,299 euros. T. S. Kvainickas calculates that the average price of housing in the economy class segment of new housing increased from 2659 to 2694 Eur / sq.m. per month. Prices for middle-class housing rose from 3814 to 3824 Eur / sq.m. In the prestigious segment, prices decreased from 5381 to 5269 Eur/ sq.m. Lofts were also slightly cheaper – from 2327 to 2260 Eur/ sq.m, and the prices of cottages increased from 1848 to 2080 Eur / sq.m. Price fluctuations in May were not large, they were influenced by both changes in the structure of supply (new projects, apartments sold) and changes in pricing in individual projects.

"With a decrease in the delivery of new projects to buyers in May, the value of the market balance indicator decreased from 2.22 to 2.04, which indicates a positive direction. With the Euribor indicator still growing, not only does the total loan payment increase, but also the proportion between the interest paid and the part of the loan to be repaid is changing. Along with the real decline in housing affordability, this encourages a larger part of the population to rent housing, but with high interest rates and remaining expensive housing development, rent adjustments are also likely," predicts T.S. Kvainickas.

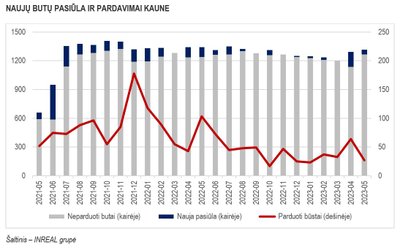

In Kaunas, activity fell on the activity of the new housing market in Kaunas, according to T. S. Kvainickas, decreased – 27 housing units were sold (30 new agreements, 3 – canceled). This is almost twice less than a month ago (64, 69, 5, respectively) and about 4 times less than last year in the same period (103, 121, 18). The indicators of May in Kaunas are more similar to the results of the end of last year or the I quarter of this year, so there were no cardinal changes. "Lower sales were also accompanied by lower developmental activity. " Inreal added 52 new objects to the databank – 3 times less than a month ago (154) and 2 times less than a year ago (102). The amount of supply has increased from 1292 to 1317 and has remained at a similar level for almost two years now," the real estate analyst calculates.

No significant price corrections were recorded in May, he said. Economy class new Housing In Kaunas, the price increased from 1748 to 1781 Eur/sq.m, the average ones – from 2778 to 2784 Eur/sq.m, the prestigious ones – from 3752 to 3796 Eur/sq.m. In the loft and cottage segments, the average prices have remained largely unchanged and currently, respectively, reach 2109 and 1681 Eur / sq.m.

As sales declined and housing supply increased slightly, the market balance indicator increased slightly from 1.86 to 1.99.

Klaipeda is encouraging

The largest decrease in the activity of the new housing market was recorded in Klaipeda. T. S. Kvainick says that in a month 4 housing units were sold here (6 new agreements, 2 returns). This is 8 times less than in April (32.32.0, respectively), and similar to the results of May last year (2, 10, 8). During the month, Inreal added 89 new homes to the databank, which is one-third less than in April (137). Supply has increased from 452 to 537 and is currently about 1.5 times higher than the supply level that has prevailed for several years (350).

In Klaipeda, as in Vilnius and Kaunas, no fundamental changes in the price were recorded. Economy class new housing costs about 1725 Eur / sq.m, medium – about 2415 Eur / sq.m, cottages – about 1584 Eur / sq.m. "In Kaunas and Klaipėda, there is a pronounced influence of reserved housing, so buyers who seek to buy a home today should focus on prices about 10 percent higher than those indicated in this review," says T.S. Kvainickas.

Growing supply also increases the market balance indicator. During the month, it grew quite significantly, from 1.72 to 2.33. "Looking at the change from the end of the first quarter, when the balance sheet indicator reached 1.37, the "cooling" of the market is especially pronounced. As we predicted just last year, the relatively balanced market in the port city was due to extremely low supply, and with a significant increase in it, a buyer's market was formed. Now we are watching whether new projects will attract the attention of buyers. The growth of the population of the city of Klaipeda coincides with the beginning of the war in Ukraine. "Inreal's demographic calculations are guided by ICD data, which also includes some war refugees, so although demographic changes are not unambiguous, they create the prerequisites for the growth of housing market activity," predicts T.S. Kvainick.